Persons With Respect to Certain Foreign. How to Refer External JavaScript file in K2 SmartForms.

The integration between Forms and Workflows boils down to using Rules and Actions to start Workflows and opencomplete.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

. Person filing Form 8865 with respect to a foreign partnership that has made an MTM election described in Treas. Income Tax Return for an S Corporation. The behavior of Start Forms and Task Forms for Workflows was discussed in the 100YYZ SmartForms Fundamentals course but using a K2 Designer Workflow.

Here we will apply the same concepts to a Workflow built in K2 Studio. K-2 Visas are issued to the childchildren of your fiance e sponsored under the K-1 visa process. In this article the K2 applicant is sometimes referred to as a child.

But of course thats not always the case as heshe might be older. For example Part II Foreign Tax Credit Limitation includes two sections and Part III Other Information for Preparation of Form 1116 or 1118. Do you provide STS services.

- Write the JS file upload it to a Site Assets folder in SharePoint though this can be any web server users have access to - Drop on a data label with the Literal setting set to TRUE. Helpful comments were received and changes have. June 2021 July 2020 December 2019 May 2019 June 2018.

I need someone to generate K2 form may i know the cost per k2 form and also the cut off time per day. Taking Form 1065 Schedule K-2 as an example there are 11 parts in total Part XII in the final version was reserved for future use with such parts being further divided into different sections. Similarly a US.

If you have items of international tax relevance youre required to report them on Schedules K-2 and K-3 if you file. - Add the. K3 form can be done ur com.

To add to Scotts comments my setup is as follows. To be sure that your soon-to-be family will be complete youll need your fiance es. Schedules K-2 and K-3 are new for the 2021 tax year.

11291-1c4 for a PFIC should report the partnerships MTM gain or loss on Schedule K Form 8865 and report the partners share of such amounts on Part III of Schedule K-1 Form 8865. Form 8865 Return of US. Return of Partnership Income.

The Treasury Department and the IRS released prior drafts of Schedules K-2 and K-3 for the Form 1065 in July 2020 and engaged with stakeholders to solicit input on the changes.

All About Logistics Customs Form No 2 K2

New 2022 Irs Changes Funds Partnerships Required Schedule K 2 And K 3 Us Tax Financial Services

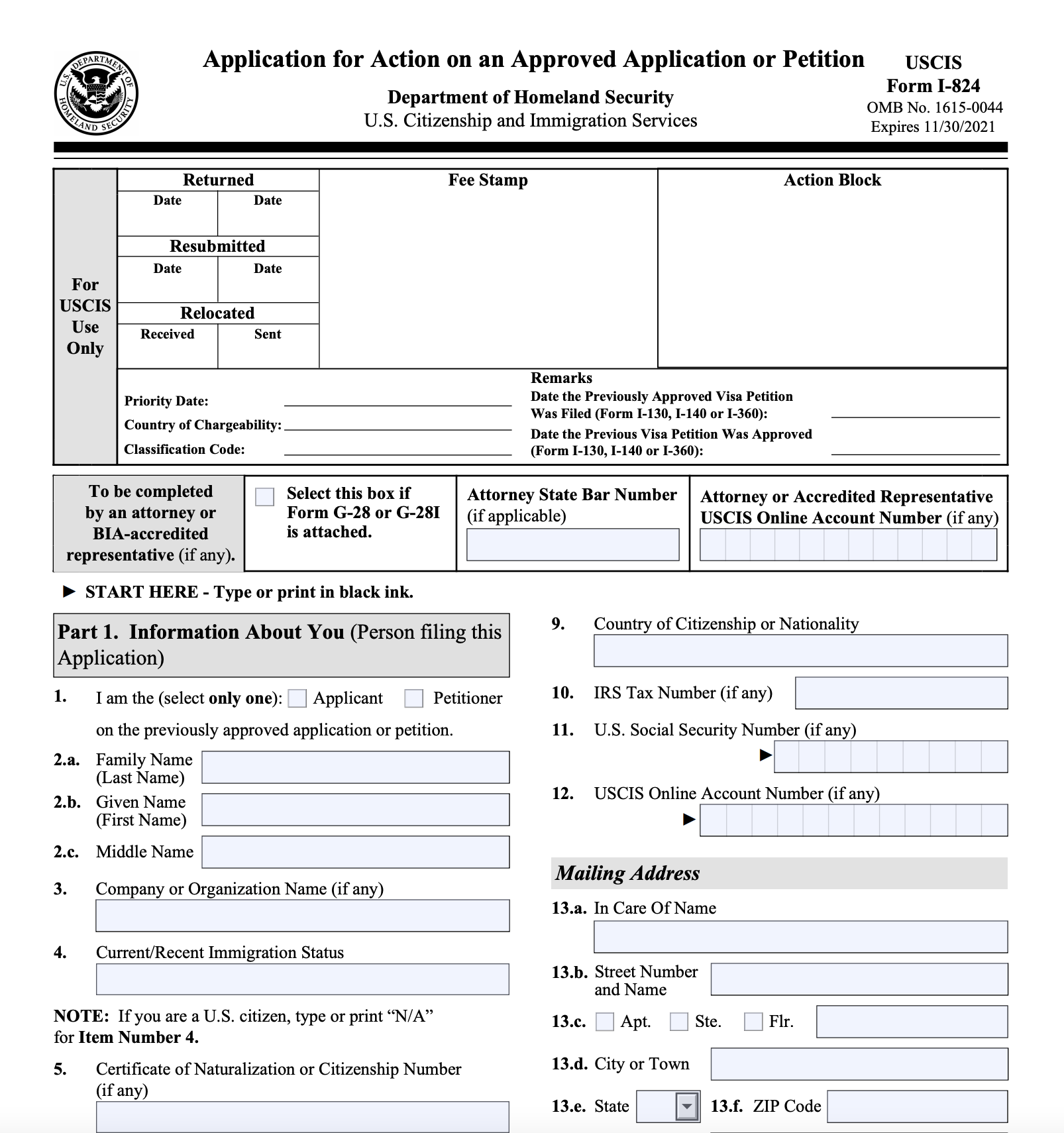

Form I 824 Explained Filing Tips Fees Processing Time

10 Best Free Printable Medical Cards

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

Employee Demotion Authorization Form

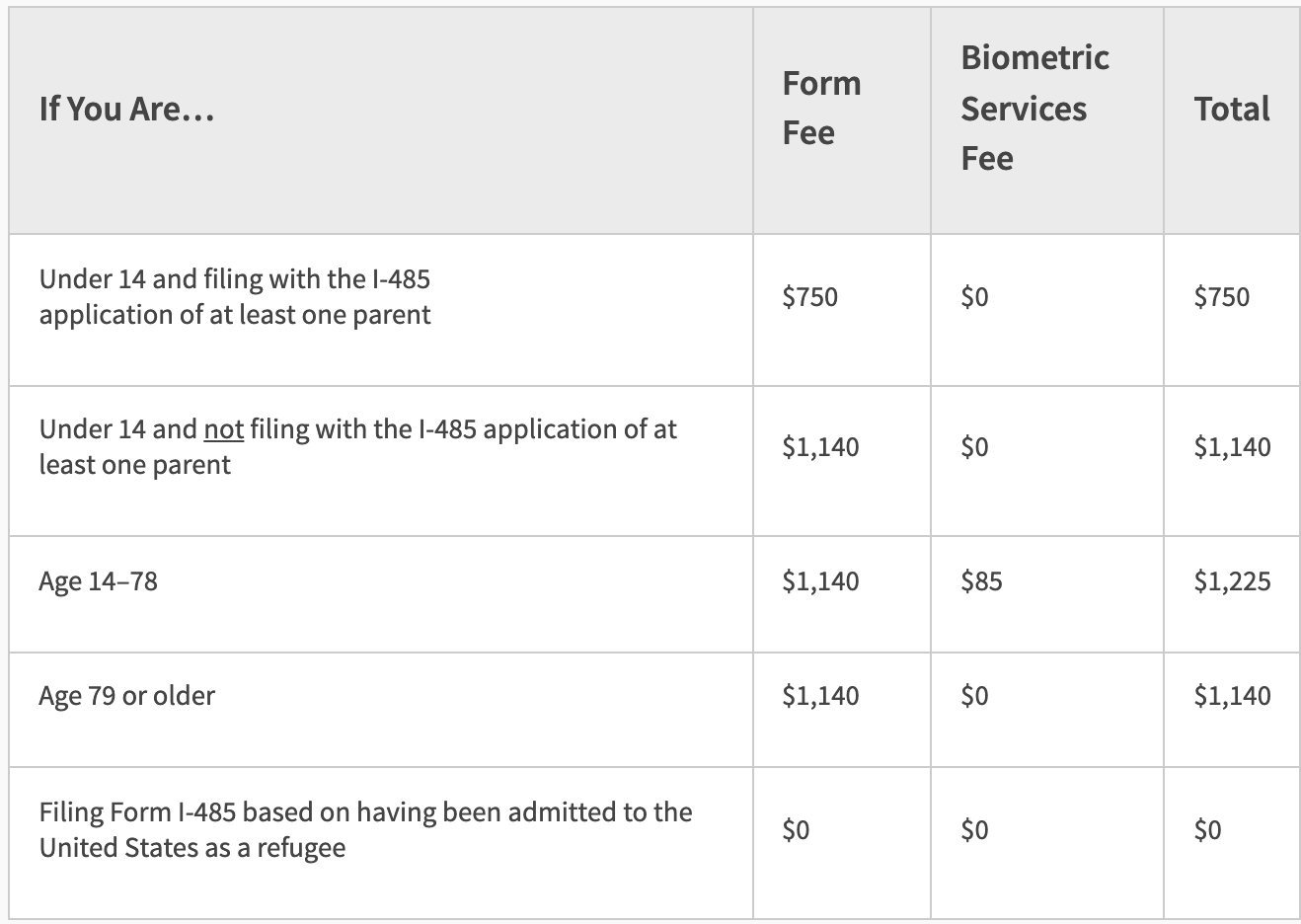

K2 Child Adjustment Of Status Checklist Uscis Form I 485 Lovevisalife

K 1 Adjustment Of Status After Marriage 2022 Step By Step Guide

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits